MPAI – the international AI-based data coding standards developing organisation – has published an epoch-marking AI-based standard called MPAI-CUI (Compression and Understanding of Industrial Data) that allows the assessment of a company from its financial, governance and risk data.

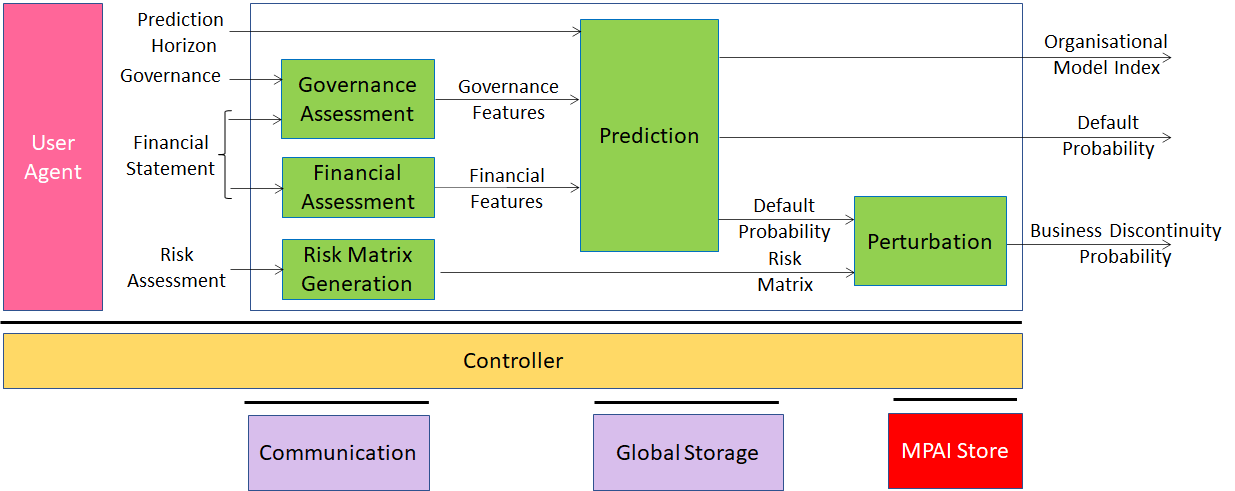

An implementation of the standard is composed of several modules pre-processing the input data. A fourth module – called Prediction – is a neural network that has been trained with a large amount of company data of the same type as those used by the implementation and can provide an accurate estimate of the company default probability and the governance adequacy. The fifth module – called Perturbation – takes as input the estimation of the company default probability and the assessment of vertical risks (i.e., seismic and cyber) and estimates the probability that a business discontinuity will occur in the future.

The MPAI-CUI standard is complemented by a second specification call Conformance Assessment. This allows a user of an implementation of the standard to verify that the implementation is technically correct.

The standard is further complemented by a specification called Performance Assessment. The goal of the specification is to allow a user to detect whether the training of the neural network was biased against some geographic locations (e.g., North-South) and some industry types among the four currently supported: service, public, commerce and manufacturing.

The novelty of MPAI-CUI is in its ability to analyse, through AI, the large amount of data required by regulation and extract the most relevant information. Moreover, compared to state-of-the-art techniques that predict the performance of a company, MPAI-CUI allows extending the time horizon of prediction.

Companies and financial institutions can use MPAI-CUI in a variety of contexts, e.g.:

- To support the company’s board in deploying efficient strategies. A company can analyse its financial performance, identifying possible clues to the crisis or risk of bankruptcy years in advance. It may help the board of directors and decision-makers to make the proper decisions to avoid these situations, conduct what-if analysis, and devise efficient strategies.

- To assess the financial health of companies applying for funds/financial help. A financial institution receiving a request for financial help from a troubled company, can access the company’s financial and organisational data and make an AI-based assessment, as well as a prediction of future performance of the company. This helps the financial institution to make the right decision whether funding that company or not, based on a broad vision of its situation.

MPAI organises a public workshop to promote understanding and potential of use of MPAI-CUI in the industry. The event will be held on 25th of November 2021 at 15:00 UTC with the following agenda:

- Introduction (5’) – will introduce MPAI, its mission, what has been done in the year after its establisment, plans

- MPAI-CUI standard (15’) – will describe

- The process that led to the standard: study of Use Cases, Functional Requirements, Commercial Requirements, Call for Technologies, Request for Community Comments and Standard.

- The MPAI-CUI modules and their function.

- Extensions under way.

- Some applications of the standard (banking, insurance, public administrations).

- Demo (15’) – a set of anonymous companies with identified financial, governance and risk features will be passed through an MPAI-CUI implementation.

- Q&A